The Commission for Aviation Regulation has written off as a bad debt the €140,927 owed to it by Manorcastle Ltd, formerly trading as United Travel, which failed to discharge two awards of costs made against it by the High Court. However, the Commission has commenced legal proceedings to seek payment of a bond, issued to Portlaoise Travel Ltd, against the bank that provided the bond. The Commission’s 2012 annual report also states that the final report of the liquidator of Fáilte Travel Ltd is awaited.

In his Foreword to the annual report, Commissioner Cathal Guiomard said: “In the licensing areas, we renewed 280 travel trade licences, ensuring that their customers would if necessary be refunded or repatriated. We established that 60 airlines and ground handlers satisfy ownership and business requirements, including financial fitness and insurance cover. We also responded to more than 3,000 air passenger queries, and investigated some 500 eligible passenger complaints.”

As regards enforcement of air passenger rights, he said: “The 2012 results record a marked improvement (on 2011): the Commission concluded more than three-quarters of investigations into passenger complaints within three months of the receipt of the complaint.

“Nonetheless, a factor in the time required is also the degree of co-operation received from airlines. The majority of airlines now co-operate fully during the complaint handling process (such that only complex cases or cases contingent on pending case-law are protracted). Unfortunately, in recent years Commission has had to engage at length on numerous occasions with American Airlines, Aer Lingus and Turkish Airlines to resolve cases which we believe should have been straightforward. At the beginning of 2012, many investigations that had taken longer than they should have to conclude concerned these airlines. Some improvement was observed in the second half of 2012. We continue to seek further improvements from these air carriers.”

Licensing and Approvals

The annual report states that: “The Commission continued to administer the licensing and approval regimes for air carriers, groundhandlers and travel trade firms in Ireland. As shown in table 3.1 below, there was no change in 2012 in the overall number of approved groundhandlers, although the figures for licensed travel firms and air carriers decreased marginally.”

Travel Trade Licensing

Travel Trade Licensing

The report’s section on travel trade licensing reads as follows:

“The Commission granted licences to 273 travel firms in 2012. There was a small decrease (3) in the number of travel agents while tour operator numbers were unchanged. 2012 was the second successive second year in which no licensed firms went out of business, so we did not need to administer refunds or organise repatriations.

“The Commission records and publishes certain performance indicators, including in regard to our licensing work. Part of our travel trade licensing work involves issuing a letter to applicants advising them to proceed to seek a bond; we call this a decision-in-principle letter. We aim to issue such letters within one month of receipt of a completed application. In 2011, we met our target for 81% of applications, but in 2012 that proportion fell to 46%. Reasons included reduced staffing and additional scrutiny of applications prior to issuing such letters. However, we made up time later in the process such that all eligible 2012 applicants received their licences prior to the licence renewal date.

“We received 18 complaints concerning possible unlicensed trading. In 3 cases no further action was required. Of the remaining 15 cases, we are engaging with these entities to establish if any unlicensed activity has taken place and what action is required to be taken in each case.

“Forty eight licence holders have now availed of the exemption from producing audited accounts.

“We visited the business premises of 42 licence holders in 2012, to establish that they were keeping necessary records and otherwise were in compliance with legal requirements.

“The final report of the liquidator of Fáilte Travel Ltd is awaited. Separately, the Commission has commenced legal proceedings to seek payment of a bond, issued to Portlaoise Travel Ltd, against the bank that provided the bond. The Commission is also defending an action by a travel agent seeking to recover monies expended following its taking over the bookings of customers affected by another firm’s going out of business. Finally, Manorcastle Ltd, formerly trading as United Travel, has failed to discharge two awards of costs made against it by the High Court in favour of the Commission, amounting to €140,927. This amount has been written off as a bad debt in our 2012 Financial Statements.

“The Travellers Protection Fund is used where the bonds provided by tour operators and travel agents fail to cover the full costs of repatriations, refunds to customers and administration costs of the Commission in the processing of claims. The balance in the account at end-2012 was €5,146,054.

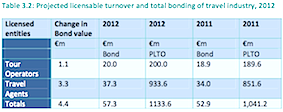

“Tour operators are required to provide bonds of 10% of their projected licensable turnover (PLTO) each year. Travel agents are required to do likewise at a rate of 4%. The table below gives the value of bonds and PLTO for 2012 and 2011.

“The turnover shown above does not include the amounts expected from the non-licensable parts of travel businesses.”

“The turnover shown above does not include the amounts expected from the non-licensable parts of travel businesses.”